Demat and Trading Account – Fees and Charges

Before buying any product or service, it is pivotal to ascertain the costs associated with the transaction. Whether you purchase a car or subscribe to the membership of an e-commerce platform, you must carefully review the entire list of charges; opening a demat and trading account is no different. During the process of trading and demat account opening, you must compare various demat account offerings on various parameters, including demat account charges, and then make your selection. In this article, we shall discuss the process of demat account opening and the major categories of demat account charges you should be mindful of.

Process of demat account opening in India

With the application of technology, the demat account opening process in India has become extremely streamlined. You can complete the entire process digitally, including the submission of the required documents. Here are the steps you can follow for online demat account opening in India.

- Select a demat account offering that is in line with your investment needs and goals as well as within your budget.

- Access the official platform of the selected depository participant.

- Fill the demat account opening form.

- Submit the necessary documents such as copies of valid proof of identity, address, and income, recent passport size photographs, and PAN card.

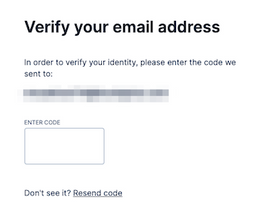

- Carry out the process of In-person Verification through a video call.

- Submit the demat account opening application and wait for the DP to process it.

Major categories of trading and demat account charges

There are various types of trading and demat account charges that you should be aware of. While assessing and comparing various demat account offerings, you must meticulously study the schedule of charges for each offering. Here are the prominent categories of trading and demat account charges.

- Account Opening Charges: This type of demat account charge is levied right at the beginning of the demat account opening process. It is usually a nominal fee and most depository participants waiver it. You can easily find several demat account offerings with zero account opening charges.

- Transaction Charges: Once the demat account opening process is complete and your demat and trading account is functional, you can start buying and selling securities in the market. Each time you place a buy or sell order, the stock exchange levies a charge termed as transaction charges. This type of demat account charges can be a flat fee or a percentage of the amount of the transaction.

- Annual Maintenance Charges: For maintaining your demat and trading account, your depository participant or stock broker is also allowed to charge an annual maintenance fee. This demat account charge is usually in the range of Rs. 600 to Rs. 1000 (varies from one DP to another). Some DPs offer a waiver of AMC for the first year.

- Custodian Charges: Since your depository participant safely holds your market-linked assets, they charge a fee called custodian charges for the service.

- SMS charges: Another type of trading and demat account charges is the fee for regular alerts shared by your DP or stock broker.

- Dematerialisation charges: This type of demat account charge is levied in case you request the conversion of existing physical securities (for example, paper-based share certificates) into a digital format.

- Penalties: If you fail to pay your trading and demat account charges, you may have to pay certain penalties. Furthermore, there may be an account reactivation charge if your trading and demat account has been marked dormant (due to inactivity across a 12-month period).

The bottomline

By perusing the entire schedule of trading and demat account charges before demat account opening, you can plan your expenses pertaining to the accounts and ensure timely payment of the charges. It is also important to read all the official correspondence from your depository participant or stock broker, and be timely informed of any additional demat account charges or a revision in the charges.

Additional Read: For more information about our business and services, feel free to visit our Google My Business page.